Leasing a Car to Save Money

When the subject of leasing a car in order to save money first comes up it raises some questions, such as: Can I save money leasing a car? or What should I know before leasing a car? There are clear advantages and disadvantages to leasing, and the goal of this post is to help you discover what you need to know so you can make the decision that is best for you.

Can I Save Money Leasing a Car?

The decision to lease a car can largely be answered by examining your priorities. For example, are you more worried about making financial sense and save some money on your monthly budget, or you need a car that can be used for work and also for the family?

Always consider your short and long-term goals. You definitely can save money leasing a car but you will be also limited to a certain monthly mileage (usually 10,000 miles/year or 833 miles/month or 27,7 miles/day, and you will be charged extra fees if you overpass this limit), If you think you will be needing this car for work as a delivery or rideshare driver, or your work location is more than 30 miles away from home, leasing is not your answer.

On the other side, if you just want to save some money while not using your car for more than the mileage limit and also would like to get the benefits of change to a newer model every 2 years, then leasing is for you.

What to Know Before Leasing a Car

Whereas loan payments are calculated off of the sales price, interest rate, and how many months it will take to repay the loan amount, lease payments are calculated a bit differently. Lease payments take into account the sales price of the vehicle, the length of the lease, anticipated mileage, residual value, rent charge, taxes, and fees. Also, in some cases, a down payment is required. As with a loan, the more you put down, the less the lease payment will be each month.

Since leases vary widely, it is important to shop around and consider all the factors before signing a lease. Make sure you understand what you are paying, why, and that it is the best deal available. Also understand what interest you are expected to pay, as this can make a big difference. A good thing to consider is gap insurance (this comes in handy if you are in an accident), and if this is included in the lease. If not, it will be an extra cost and there may be other leases available that include it.

As with anything, there are advantages and disadvantages to leasing a car. Some of these are summed up below to help you weigh them out with your individual needs and preferences.

The Advantages of Leasing a Car

- Monthly Lease Payments are Lower than Loan Payments

- You May Purchase the Vehicle for a Pre-Arranged Price when the Lease Ends

- No Resale Hassle

- Maintenance Usually Included

- Tax Deductions if the Car is Used for Business Purposes

- Access to Newer Technology/Safety Features Every Few Years

The Disadvantages of Leasing a Car

- No Equity

- Monthly Mileage limitations

- Additional Fees

- You May Pay More in the Long Run

- Less Flexibility in Customization

- Cost of Gap Insurance if Not Included in Lease

- Responsibility of Owning Without Ownership

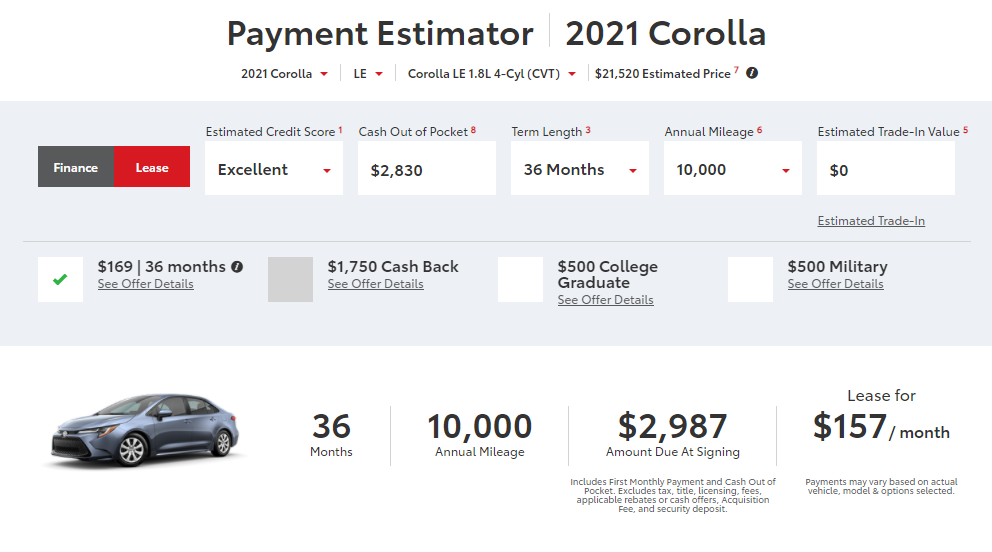

Lease deal real Example

As always never get fooled by cars dealers promotions, the price presented here is only for “qualified customers” that has their credit score above 720 points, but if you fall below this number you could push them expressing that you will not make any deal if you don’t get the best price, just walk away, they will be calling you in a day or two. You will notice that the price difference between an excellent credit score and a great or good credit score will increase your monthly payment by about $60 (almost 40% increment!), at this price you will not be saving much, you maybe will be paying about the same of purchasing a car.

Note that this deal has a mileage limit of 10,000 miles per year as I mentioned before.

Last Thoughts

Leasing a car is a very individual decision that is based on many factors. As I mentioned, these include your short and long-term goals, income level, as well as your set of priorities. There are both advantages and disadvantages to leasing a car, so be sure to consider some of the points covered before making your final decision.